BANGKOK – The Asia-Pacific area was helped by Vietnam, but not enough to make up for China’s weakening economy, according to a lower World Bank annual growth prediction.

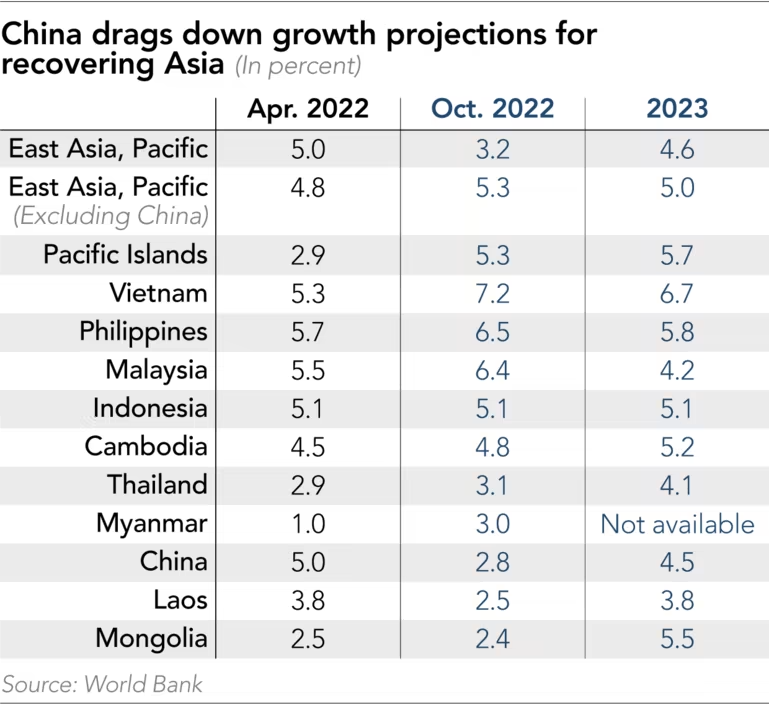

The bank drastically cut its latest economic projection, which was released on Tuesday, downgrading China’s growth from 5% in April to 2.8% now. This reduced the region’s anticipated growth for this year from 5% to 3.2%, which was the prediction in April. Japan and the two Koreas are left out of the report, which covers East Asia, Southeast Asia, and the Pacific islands.

With annual growth of 7.2%, up from the prediction of 5.3% in April, Vietnam is expected to outperform the rest of the region. At 5.1%, the forecast for Indonesia remained the same. The region’s projected growth in 2022, excluding China, is 5.3%, with predictions for Malaysia, the Philippines, and Thailand being raised.

According to Aaditya Mattoo, chief economist for East Asia and the Pacific, “the big source of growth in the region today has been the release from the restrictions that countries were forced to maintain, either through rules or the spontaneous restraints that people exercised on consumption during the COVID period.”

Although China still adheres to its zero-COVID policy and occasionally implements lockdowns in major cities, the majority of the region has reopened to travel and eased pandemic restrictions. By the end of the year, the bank forecasts that the output in the Philippines, Thailand, and Cambodia will reach pre-pandemic levels. Despite decreasing growth, China’s output continues to surpass the rest of the region after previously recovering to levels higher than before the epidemic.

Inflation, higher interest rates, and weaker currencies reduce the countries’ ability to purchase goods and pay their debts, which causes the growth predictions for Laos and Mongolia to be reduced. Their economies are anticipated to recover next year, with a growth of 5.5% estimated for Mongolia, 4.5% for China, and 3.8% for Laos. Their growth, along with that of China, will be less than 3% this year.

The majority of the area, except Laos and Mongolia, would be able to withstand the U.S. Federal Reserve’s expedited interest rate increases “quite well,” according to Mattoo since more debt is domestically rather than internationally denominated.

The Solomon Islands, Tonga, Samoa, and Micronesia are expected to decrease, while Fiji, which is expected to grow by 12%, will account for the majority of the growth in the Pacific islands.

However, the price controls, subsidies, and trade restrictions that maintained regional inflation at 4% on average, lower than the rest of the globe, might stifle long-term growth by encouraging inefficient agricultural production and high-carbon energy sources.

In comparison to other emerging regions outside of the Middle East and North Africa, the Asia Pacific has more items subject to price restrictions, according to the research. Although customers are increasingly favoring vegetables, fruits, and meat, assistance programs are weighted toward rice and other grain growers.

Additionally, the present policies are reversing years of falling fossil fuel subsidies. Fossil fuel subsidies in Indonesia and Malaysia have increased from roughly 1% of GDP in 2020 to over 2%. The bank cautioned that this reversal might jeopardize efforts to reduce carbon emissions and keep nations dependent on the importation of fossil fuels, putting them vulnerable to future price shocks.

As Indonesia, Thailand, and Malaysia prepare for elections next year, the World Bank encouraged governments to strike a balance between long-term sustainability and short-term public welfare and political prerogatives. According to the bank, targeted income transfers would be less expensive than general giveaways and subsidies. The bank determined that in Thailand, 2.2 billion baht ($58.2 million) in cash transfers would result in a 1 percentage point decrease in poverty; but, this result would necessitate 11.2 billion baht in fuel subsidies.

Long-term price supports, according to the bank, will increase budget deficits and divert money from infrastructure, health care, and education. The public debt to GDP ratios in Thailand, the Philippines, and Malaysia will conclude the year higher than predicted, exceeding 60% in all three nations.

As the market for the region’s exports has shown symptoms of waning, investments to maintain long-term growth will be required. The demand for electronics, many of which are produced and put together in China, Vietnam, and Malaysia, is slowing down, according to quarterly data from American merchants, the World Bank stated. The Asia-Pacific region’s growth might be reduced by more than 1 percentage point this year if key economies experience recessions, with Malaysia suffering the greatest loss at 0.8 percentage points.

Aw, this was an exceptionally nice post. Finding

the time and actual effort to generate a top notch article… but what can I say… I put things off

a whole lot and never manage to get nearly anything done.

получить 1000 рублей бесплатно за регистрацию игровые автоматы слоты с бонусами

get cheap lipitor without insurance

Купить водительские права официально

Hi! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly?

My blog looks weird when browsing from my apple iphone.

I’m trying to find a theme or plugin that might be able to resolve this problem.

If you have any recommendations, please share.

Thank you!

ラブドール えろand promising approaches should incorporate a scientifically rigorous evaluation plan.recent evidence from behavioral skills-oriented sex education programs suggest the practical utility of emphasizing two fundamental and specific messages in a social learning theory paradigm.

скачать вулкан

It is perfect time to make some plans for the future and it is time to be happy.

I’ve read this post and if I could I want to suggest you few interesting

things or advice. Perhaps you can write next articles

referring to this article. I wish to read

even more things about it!

Hello my loved one! I want to say that this post is awesome, great written and

include almost all vital infos. I would like to look more posts like this .

Thank you for the auspicious writeup. It in fact

was a amusement account it. Look advanced to

far added agreeable from you! However, how could we communicate?

Fantastic goods from you, man. I’ve understand your stuff previous to

and you’re just too magnificent. I really like what you have acquired here, really like

what you are stating and the way in which you say it.

You make it entertaining and you still care for to keep it

smart. I cant wait to read far more from you. This is actually a wonderful site.

can you buy cheap vasotec without insurance

Magnificent beat ! I would like to apprentice at the same time as you amend your website, how can i subscribe for a blog website?

The account helped me a acceptable deal. I have

been a little bit familiar of this your broadcast provided bright clear concept

Everything is very open with a really clear explanation of the challenges.

It was really informative. Your website is very useful.

Thank you for sharing!

nhà cái net88 cam kết mang đến dịch vụ cá cược uy tín, hệ thống bảo mật tiên tiến và hỗ trợ khách hàng 24/7, đảm bảo người chơi có trải nghiệm tốt nhất.

Wow, marvelous blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your site is wonderful, let alone

the content!

where to buy caduet no prescription can i purchase caduet without insurance cost of cheap caduet without dr prescription

get cheap caduet pills where can i buy caduet without dr prescription how can i get generic caduet price

can you get generic caduet without dr prescription

can i purchase cheap caduet tablets can i order generic caduet no prescription can you buy caduet price

can i order caduet online cost cheap caduet without dr prescription order caduet prices

Good article. I’m facing some of these issues as well..

I am not sure where you’re getting your information, but great topic.

I needs to spend some time learning more or understanding more.

Thanks for fantastic information I was looking

for this info for my mission.

Hi there great website! Does running a blog similar to this

take a great deal of work? I’ve very little understanding of

coding however I had been hoping to start my own blog

in the near future. Anyways, if you have any suggestions

or techniques for new blog owners please share. I know this is off topic however I simply

needed to ask. Appreciate it!

Good – I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, website theme . a tones way for your customer to communicate. Nice task.

Hi, I think your site might be having browser compatibility issues.

When I look at your website in Chrome, it looks fine but when opening in Internet Explorer,

it has some overlapping. I just wanted to give you a quick heads up!

Other then that, great blog!

На площадке представлен широкий ассортимент травматического оружия https://travmat-kupit.ru/

Отличный выбор для быстрого обновления интерьера с минимальными затратами – https://potolki-v-moskve.ru/

Simply desire to say your article is as astounding.

The clarity for your put up is just great and that i can assume you are a professional on this subject.

Well with your permission let me to take hold of your feed to

stay up to date with drawing close post. Thanks

a million and please keep up the rewarding work.

Hi! I could have sworn I’ve been to this web site before but after

looking at many of the articles I realized it’s new to me.

Anyways, I’m definitely pleased I discovered it and I’ll be book-marking it

and checking back regularly!

get micardis pills

I have read so many content concerning the blogger lovers

but this piece of writing is in fact a pleasant article, keep it up.

Hmm it looks like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new to everything.

Do you have any recommendations for inexperienced blog writers?

I’d genuinely appreciate it.

Oh my goodness! Amazing article dude! Thanks, However I am going through

troubles with your RSS. I don’t understand why I cannot join it.

Is there anyone else getting identical RSS problems?

Anyone who knows the answer will you kindly respond?

Thanks!!

I got this web site from my pal who informed me regarding this website and now

this time I am browsing this web page and reading very

informative articles at this time.

I have been surfing online greater than three hours lately,

but I by no means found any interesting article like yours.

It’s pretty price enough for me. Personally, if all website owners and bloggers made excellent content as you did, the net will be a lot more helpful than ever before.

Simply want to say your article is as amazing. The clearness on your submit is simply great and i could suppose you’re a professional in this subject.

Fine with your permission let me to grasp your feed to keep

up to date with coming near near post. Thanks one million and please keep up the enjoyable work.

You actually make it seem so easy with your presentation however

I find this topic to be really one thing that I think I might never understand.

It kind of feels too complex and extremely vast for me. I’m

having a look ahead to your subsequent submit, I’ll attempt to get the grasp of it!

Way cool! Some very valid points! I appreciate you penning this

write-up and the rest of the website is also really good.

прокат авто на сутки аренда авто адлер без водителя

cost generic zanaflex pill

buying prednisone 4mg without prescription can i get prednisone no prescription cost of prednisone no prescription

does prednisone help with wheezing is it illegal to buy prednisone online without a perscription prednisone at Walmart

legal to buy prednisone online

use of prednisone in asthma get generic prednisone without insurance otc version of prednisone

does prednisone help fight infection prednisone breastfeeding baby side effects prednisone dose pack side effect

https://archive.org/details/@ivan1977g5x

Хотите ощутить азарт в популярном казино?

Тогда вам в Эльдорадо Казино!

платформа для азартных игр Вы найдете лицензионные игровые автоматы, прибыльные акции и

удобные финансовые операции!

Какие преимущества ждут игроков?

Коллекция игр от ведущих провайдеров.

Щедрые награды на старте игры.

Эксклюзивные розыгрыши на постоянной основе.

Оперативный вывод средств на удобные платежные системы.

Удобная навигация в любом месте.

Круглосуточная поддержка работает без выходных.

Регистрируйтесь прямо

сейчас и ловите удачу прямо сейчас! https://casino-eldorado-klub.com/

It’s actually a great and useful piece of info.

I am happy that you shared this helpful info with us.

Please stay us up to date like this. Thanks for sharing.

В Уфе лазерное лечение варикоза становится все более популярным и доступным. Флебологи в Уфе предлагают широкий спектр услуг, включая эндовазальную лазерную коагуляцию (ЭВЛК), лазерную флебэктомию и лазерную терапию варикоза. Эти методы позволяют эффективно и безболезненно удалять варикозные вены, минимизируя риск осложнений и сокращая период восстановления. Флеболог с лазерным оборудованием Уфа

I completely agree with your thoughts on this. I read something very similar on bossfun.zone, and the detailed analysis there helped me understand the matter better.

What’s Happening i’m new to this, I stumbled upon this

I have discovered It absolutely useful and it has aided me out loads.

I hope to give a contribution & aid different users like its helped me.

Great job.

The other day, while I was at work, my sister stole my iPad and tested to see if it can survive a thirty foot drop, just so she can be a youtube

sensation. My apple ipad is now destroyed and she

has 83 views. I know this is entirely off topic but

I had to share it with someone!

сіно солома різниця

Аркада казино, или казино аркада, – это относительно новое направление в индустрии азартных игр, которое стремится сочетать элементы классических аркадных игр с традиционными казино-играми. Этот гибридный формат нацелен на привлечение более молодой аудитории, выросшей на видеоиграх, и тех, кто ищет более интерактивный и захватывающий опыт, нежели стандартные слоты и настольные игры. казино оркада аркада официальный сайт

great post, very informative. I ponder why the other experts of this

sector don’t notice this. You must proceed your writing.

I’m confident, you’ve a huge readers’ base already!

cost cheap keflex without a prescription

where to get generic clomid tablets how can i get cheap clomid without prescription where buy cheap clomid for sale

can you get cheap clomid without a prescription where buy clomid pill where to buy generic clomid without a prescription

buy clomid tablets

cost of cheap clomid without prescription where to buy clomid no prescription how can i get clomid without rx

can i get cheap clomid order clomid without dr prescription can you get clomid prices

https://www.openstreetmap.org/user/Ivan1977g5x

娛樂城,通常指的是一個線上賭博平台,提供各種娛樂遊戲,如賭場遊戲、體育博彩、電子遊戲等。這些平台讓玩家可以在網路上進行賭博,而不需要親自前往實體賭場。娛樂城通常包含了各式各樣的遊戲選項,例如百家樂、輪盤、老虎機、撲克等,並且透過即時娛樂、直播等技術,提升了玩家的沉浸感和互動性。現今的娛樂城大多數已經支援手機和桌面端的多平台操作,讓玩家可以隨時隨地參與遊戲,這樣的便利性使得它們受到全球玩家的青睞。此外,娛樂城也會推出不同的優惠活動、註冊獎金和忠誠計劃,吸引新用戶並保持老用戶的活躍度。然而,娛樂城的風險也不可忽視。由於賭博本身具有高度的娛樂性,但也存在可能的成癮問題。多數國家對於線上賭博有著嚴格的法律規範,玩家在選擇娛樂城平台時,應該格外留意平台的合法性和安全性,以避免陷入詐騙或遭遇其他法律風險。因此,理性投注並了解相關法律是每位玩家應該保持的基本態度。

зеркало armada casino

I really like your blog.. very nice colors & theme.

Did you create this website yourself or did you hire someone to do it for you?

Plz reply as I’m looking to construct my own blog and would like to know where u got this from.

appreciate it

Can I simply just say what a relief to uncover someone who truly understands what they are discussing over the internet.

You actually realize how to bring an issue to light and make

it important. More and more people need to check this out

and understand this side of the story. I was surprised that you aren’t more

popular since you certainly possess the gift.

What you posted was very reasonable. However, what about this?

what if you added a little information? I mean, I don’t wish to tell you

how to run your website, but what if you added a title that grabbed

people’s attention? I mean Vietnam overtakes China as the region’s growth leader – Viet Nam Global Commerce Association is

a little vanilla. You might peek at Yahoo’s home page and note how they

create news headlines to get people to open the links. You might add a video

or a related picture or two to grab readers interested about everything’ve got to say.

Just my opinion, it could make your posts a little livelier.

бонусы за регистрацию 1xslots бездепозитный бонус

Viagra * Cialis * Levitra

All the products you are looking an eye to are currently convenient for the duration of 1+1.

4 more tablets of identical of the following services: Viagra * Cialis * Levitra

https://pxman.net

Quality articles is the secret to attract the viewers

to pay a visit the web site, that’s what this

website is providing.

What’s Taking place i’m new to this, I stumbled upon this I’ve discovered It absolutely useful and it has

helped me out loads. I hope to give a contribution & help other users like its aided me.

Great job.

https://taplink.cc/ivan1977g5x

Produto incrível. Chegou conforme descrito.

I visited multiple web pages except the audio feature for audio songs current at

this web page is genuinely marvelous.

generic diamox for sale

Loving the info on this website , you have done outstanding job on the blog posts.

hi!,I love your writing so a lot! proportion we keep in touch more

about your post on AOL? I need an expert in this

house to solve my problem. Maybe that’s you! Looking forward to see you.

my blog DEUS88

Some doctors say that most men seeking penis enlargement

have normal-sized penises, and many may experience penile dysmorphophobia by underestimating their own penis size while overestimating

the average penis size. Keep in mind that ED is very common, and doctors are used to discussing it.

Natural remedies are helpful for managing minor ailments.

But many of the natural remedies found on the internet are

not backed by science. Second, there are no penis enlargement remedies proven to

be effective. ED rings help keep blood in the penis to maintain an existing erection.

You could get extra length (and added blood volume) by stretching out the

penile ligaments. A penis enlargement technique in which the thumb and index finger are wrapped

around the penis and repeatedly drawn away from the body in order to force blood into the glans and encourage vascularity.

Due to the risks, penis enlargement surgeries are usually only used when medically necessary.

Lose Inches to Gain Inches – Dropping excess weight in your

pubic area and stomach will make your penis appear larger.

Liposuction: With liposuction, surgeons remove

fat from the mons pubis, or area of fatty tissue that covers the pubic bone, to make

the penis appear more prominent. Buried penis: “Buried penis” is a

term used when a penis is concealed within excess pelvis fat.

A micropenis, usually diagnosed at birth, is

where the penis is 2.5 standard deviations less than the average stretched

penis length (2.3 to 2.5cm depending on ethnicity).

Penis enlargement surgery for increased length and

girth: This is day-care (no need for an overnight stay in hospital) surgical procedure, which can simultaneously increase

a man’s penile length and girth. Injections can increase the girth of the

penis as well increasing the length of the flaccid (soft) penis.

At best, surgery may give a slight increase in girth to the penis.

Penis enlargement surgery is not the only way to increase the size of

your penis. Is there any way I can make my penis bigger with out byeing something, like something home made or exercises, please email me back with an answer as soon as possible.

https://textme.work/

Hi, I think your blog might be having browser compatibility issues.

When I look at your website in Firefox, it

looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, terrific blog!

can i purchase inderal how to get inderal without insurance get inderal without rx

get cheap inderal without insurance can i buy inderal price cost of inderal price

generic inderal no prescription

how to buy generic inderal pill buying cheap inderal without rx can i purchase cheap inderal without a prescription

can i buy inderal no prescription where to get generic inderal online buying generic inderal prices

Glory Casino

where can i get dipyridamole

My spouse and I stumbled over here different page and thought I

might as well check things out. I like what I see so i am just following you.

Look forward to checking out your web page yet again.

This is really interesting, You are a very skilled blogger.

I have joined your rss feed and look forward to seeking more of

your magnificent post. Also, I’ve shared your website in my social networks!

Займ на карту без проверок микрозайм онлайн на карту без проверок

Займы по интернету займ получить

I needed to thank you for this fantastic read!! I definitely

enjoyed every little bit of it. I’ve got you book marked to check out new stuff you

post…

профессиональный ремонт автомобилей новинки автопрома

These are truly wonderful ideas in regarding blogging. You have touched some nice factors here.

Any way keep up wrinting.

I am genuinely happy to glance at this weblog posts which includes plenty of valuable data, thanks for providing these statistics.

Informative article, totally what I needed.

Beneficial stuff Many thanks!

You actually reported it exceptionally well.

Very good postings. Thank you.

Wonderful material Kudos.

You actually suggested it fantastically!

Fantastic posts. Thanks a lot.

معافیت دیسک کمر L4 L5، در نظام وظیفه به معنای عدم اعزام یا معافیت از انجام خدمت سربازی به دلیل وجود این عارضه در فرد مشمول است.

Beneficial advice With thanks.

افتتاح حساب بانکی ویژه فرهنگیان در بانک صادرات ایران، در راستای حمایت از جامعه فرهنگیان کشور، بانک ها اقدام به ارائه خدمات مالی ویژه ای از جمله افتتاح حساب بانکی ویژه فرهنگیان در بانک صادرات ایران کرده اند.

Thanks! Awesome information.

You said this exceptionally well!

Have you ever considered publishing an ebook

or guest authoring on other blogs? I have a blog

based upon on the same ideas you discuss and would love

to have you share some stories/information. I know my readers would enjoy your work.

If you are even remotely interested, feel free to send me an e mail.

Thank you, I have recently been searching

for information about this topic for a long time and yours is the

greatest I’ve discovered so far. However, what concerning the conclusion? Are

you sure about the supply?

can you buy cheap theo 24 cr without dr prescription buying theo 24 cr no prescription where can i buy theo 24 cr without prescription

how can i get cheap theo 24 cr without insurance where can i buy theo 24 cr without a prescription how can i get cheap theo 24 cr pill

cost theo 24 cr without insurance

can you buy generic theo 24 cr pills can i get generic theo 24 cr without insurance can you get generic theo 24 cr without dr prescription

buying generic theo 24 cr without prescription where to get cheap theo 24 cr how can i get generic theo 24 cr without rx

Terrific info, Cheers.

whoah this weblog is great i like studying

your posts. Keep up the great work! You understand, lots of people are hunting around for this information, you

can help them greatly.

Hi there friends, its wonderful paragraph on the topic of cultureand completely defined, keep it up all the time.

Fiquei impressionado com a eficiência. Compra certeira.

You’ve made your point pretty nicely.!

prirodni biser Durmitor Zabljak Jedinstveni planinski pejzazi, bistra jezera, kanjoni i guste sume. Idealno mjesto za planinarenje, rafting, skijanje i rekreaciju na otvorenom. Otkrijte nacionalni park pod zastitom UNESCO-a!

where buy generic etodolac without insurance

Thanks to my father who stated to me regarding this weblog,

this weblog is in fact amazing.

Wonderful blog! I found it while browsing on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks

This is my first time pay a quick visit at here and i am in fact

happy to read everthing at alone place.

This piece of writing will help the internet

viewers for creating new weblog or even a blog

from start to end.

Игровые автоматы лучшие Бесплатные спины за регистрацию без депозита

It’s genuinely very complex in this busy life to listen news on Television, so I simply use web for that reason, and get the most recent information.

Hello there, just became alert to your blog through Google,

and found that it is really informative. I am gonna watch

out for brussels. I will be grateful if you continue this in future.

Numerous people will be benefited from your writing.

Cheers!

can i purchase cipro for sale where can i buy cipro for sale where to get cipro price

buying cipro online how to get cipro no prescription cipro cf cream buy online

where to get cipro without rx

ciprofloxacin where to buy how to buy cipro without prescription can i get cheap cipro without prescription

can i purchase cipro pills where can i get cipro tablets buy cheap cipro tablets

Wonderful goods from you, man. I have understand your

stuff previous to and you are just extremely wonderful.

I really like what you’ve acquired here, really

like what you’re saying and the way in which you say it.

You make it entertaining and you still take care of to keep it wise.

I cant wait to read far more from you. This is really

a tremendous site.

Wonderful entry. It’s highly well-written and filled with useful information. Thanks for offering this information.

Hey There. I discovered your blog the use of msn. This is a really neatly written article.

I will make sure to bookmark it and come back to learn more of your helpful information. Thanks for the post.

I’ll definitely return.

where to buy tenormin prices

Heya i’m for the primary time here. I found this board and I

to find It truly helpful & it helped me out much.

I hope to offer something back and aid others like you aided me.

Currently it seems like WordPress is the top blogging platform out there right now. (from what I’ve read) Is that what you are using on your blog?

Hi every one, here every person is sharing these

kinds of knowledge, thus it’s good to read

this web site, and I used to pay a visit this webpage everyday.

buy generic doxycycline without prescription doxycycline online ordering alternative for doxycycline hyclate

doxycycline hyclate 100mg dosage where to get generic doxycycline no prescription how can i get cheap doxycycline pill

doxycycline cost australia

buying doxycycline without prescription generic doxycycline for sale where can i buy doxycycline over the counter

can i purchase doxycycline tablets can i buy doxycycline price can i get generic doxycycline without insurance

شرایط استخدام بدون آزمون بانک ها، استخدام بدون آزمون در بانکها، مسیری جایگزین برای ورود سریعتر به بازار کار بانکی محسوب میشود.

It’s the best time to make some plans for the longer term and it is time to be happy.

I’ve learn this put up and if I may I want to counsel you

some attention-grabbing issues or advice. Maybe you can write subsequent articles regarding this

article. I wish to read more issues approximately

it!

I got this web site from my buddy who shared with me concerning this

site and now this time I am browsing this site and reading very informative articles or reviews at this place.

bokep terbaik sma toket gede menyala banget

where to buy cheap adalat online

Даже при полной потере зубов возможно полное восстановление с помощью имплантов и несъёмных конструкций https://dentalaesthetics.ru/

can i buy mobic without rx can you get cheap mobic price where can i buy generic mobic

generic mobic tablets cost generic mobic online can i get generic mobic without insurance

can i get generic mobic prices

how to get cheap mobic without prescription can i purchase generic mobic without prescription cost of cheap mobic without rx

order generic mobic without rx how to get generic mobic tablets where can i buy mobic without prescription

Hello, i read your blog occasionally and i own a similar one and

i was just wondering if you get a lot of spam responses?

If so how do you reduce it, any plugin or anything you

can suggest? I get so much lately it’s driving me crazy so any help

is very much appreciated.

Remarkable! Its actually remarkable paragraph, I have got much clear idea on the topic of from this paragraph.

Feel free to visit my webpage; MPO Slot

Thanks for sharing your thoughts about audit.

Regards

Luxury1288

how to get micardis pills

Hi there! I could have sworn I’ve been to this site before but

after browsing through some of the articles I realized it’s new to me.

Regardless, I’m certainly pleased I stumbled upon it and I’ll be bookmarking it

and checking back frequently!

Link exchange is nothing else however it is simply placing the other person’s webpage

link on your page at appropriate place and other person will also do similar

in support of you.

I’m really loving the theme/design of your website.

Do you ever run into any browser compatibility

problems? A couple of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Chrome.

Do you have any suggestions to help fix this problem?

Aurora Casino is a platform where everyone can find something interesting and have

a chance at a big victory. At Aurora Casino, you’ll find not

only classic games but also the latest slots that will provide you with unique emotions.

With us, you’ll get generous bonuses and special offers

that will make your gaming experience even more thrilling.

Why choose cryptocurrency payments? We guarantee a high level of security and reliability.

You don’t need to worry about payouts — they are

fast and flawless.

When should you start playing at Aurora Casino?

Join us today to discover incredible opportunities. Here’s what awaits you:

At Aurora Casino, you’ll find attractive bonuses and regular promotions.

We guarantee you quick payouts and fair play.

Aurora Casino regularly updates its selection of games to keep you entertained.

With us, you can always expect thrilling moments

and big wins. https://aurora-777-spin.boats/

Appreciated the information in this article. It’s extremely detailed and filled with helpful details. Fantastic work!

I know this web page provides quality dependent articles or reviews and additional material,

is there any other site which offers these kinds of data in quality?

cheap forxiga online where can i get forxiga without prescription can you buy cheap forxiga prices

buy generic forxiga price can i order cheap forxiga without prescription how to get generic forxiga for sale

can i get cheap forxiga without a prescription

cost forxiga no prescription order cheap forxiga without rx cost cheap forxiga without rx

can i purchase generic forxiga without dr prescription can you get generic forxiga no prescription buying forxiga prices

rikvip là cổng game bài đổi thưởng uy tín, mang đến trải nghiệm giải trí đẳng cấp với hệ thống trò chơi đa dạng và tỷ lệ thắng hấp dẫn.

I all the time used to read post in news papers but now

as I am a user of web thus from now I am using net for articles, thanks to web.

nha cai uy tin cung cấp nền tảng cá cược an toàn, giúp người chơi yên tâm tham gia với các chương trình khuyến mãi hấp dẫn.

В Aurora Casino вы найдете идеальные условия для захватывающего игрового процесса

и множества возможностей для побед.

У нас представлены не только слоты

и настольные игры, но и эксклюзивные предложения для настоящих

любителей азарта. Участие в акциях и получение бонусов даст вам дополнительные шансы на

выигрыш и сделает игру еще увлекательней.

Что делает Aurora акции и предложения лучшим выбором для игроков?

Мы обеспечиваем полную безопасность ваших средств и конфиденциальность

личных данных. С нами вы можете рассчитывать на честные условия и быстрые выплаты.

Когда стоит начать ваше путешествие в мире Aurora

Casino? Не откладывайте! Присоединяйтесь к нам и начните выигрывать

прямо сейчас. Вот что вас ждет:

Большие бонусы и постоянные акции.

Мы гарантируем вашу безопасность и спокойствие, играя на нашей платформе.

Новинки и эксклюзивные игры.

В Aurora Casino вы всегда найдете яркие эмоции и шансы

на большие выигрыши. https://auroracasino7.com/

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

nha cai uy tin cam kết mang đến trải nghiệm cá cược minh bạch, với hệ thống bảo mật hiện đại và tỷ lệ cược hấp dẫn.

rikvip là lựa chọn hoàn hảo cho những ai yêu thích cá cược trực tuyến, với nhiều chương trình khuyến mãi hấp dẫn và hệ thống đổi thưởng nhanh chóng.

I was wondering if you ever thought of changing the structure of your site?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so

people could connect with it better. Youve got an awful

lot of text for only having one or 2 images. Maybe you could space it

out better?

nha cai uy tin là sự lựa chọn hàng đầu dành cho những ai đam mê cá cược trực tuyến, đảm bảo uy tín, bảo mật và dịch vụ chuyên nghiệp.

rikvip mang đến những ưu đãi đặc biệt, giúp người chơi tận hưởng các trò chơi bài và slot đổi thưởng với tỷ lệ hoàn trả cực kỳ hấp dẫn.

https://gallart.by/novosti/virtualnye-mobilnye-nomera-realnyj-aktiv-dlya-vashego-biznesa.html

Игровые автоматы на реальные деньги с выводом Бонусы без отыгрыша за регистрацию

can i buy cheap tofranil for sale

rikvip là điểm đến lý tưởng cho những ai muốn thử vận may với các trò chơi đổi thưởng chất lượng, cùng hệ thống hỗ trợ 24/7.

nha cai uy tin cam kết cung cấp sân chơi công bằng, hợp pháp, giúp người chơi trải nghiệm cá cược trực tuyến với tỷ lệ thắng cao.

Hey there, I think your blog might be having browser compatibility issues.

When I look at your blog site in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, superb blog!

Feel free to surf to my page ผลหุ้นอียิปต์ออกกี่โมง

nha cai uy tin mang đến hệ thống cá cược tiên tiến, với giao diện thân thiện, hỗ trợ 24/7 và nhiều ưu đãi đặc biệt dành cho thành viên mới.

Found your blog in the yahoo bulk shirts warehouse directory, very nice job, thanks. Screen printing could further supply for all types of other substrates from plastic to metal. Despite the fact that tiny and complex details can be gathered, screen printing is preferably ideal for bold and graphic designs.

I just couldn’t go away your web site before suggesting that

I really loved the standard info an individual supply in your

visitors? Is gonna be again often in order to inspect new posts

Hi to every one, since I am genuinely keen of reading this webpage’s post to be updated on a regular basis.

It includes pleasant material.

Hi! Quick question that’s completely off topic. Do you know how to make your site mobile friendly?

My website looks weird when viewing from my apple iphone.

I’m trying to find a theme or plugin that might be able to fix this issue.

If you have any suggestions, please share. With thanks!

Take a look at my web site slot MPOMAX

https://msk.sweet-escort.co/

Сертификат происхождения СТ-1 подтверждает, что товар был произведен в определенной стране, что важно для таможенного оформления и применения тарифных преференций. Протокол испытания, в свою очередь, документирует результаты лабораторных исследований продукции, подтверждая соответствие определенным стандартам качества и безопасности. Сертификат соответствия на продукцию удостоверяет, что товар соответствует требованиям технических регламентов или национальных стандартов. Свидетельство о государственной регистрации продукции требуется для товаров, подлежащих санитарно-эпидемиологическому надзору, и подтверждает их безопасность для здоровья человека. Декларация ТР ТС – это документ, которым производитель или импортер подтверждает соответствие продукции требованиям технических регламентов Таможенного союза. Нотификация ФСБ требуется для ввоза или вывоза продукции, содержащей шифровальные (криптографические) средства. Декларация Минсвязи, в свою очередь, необходима для оборудования связи, подтверждая его соответствие установленным требованиям в сфере связи и телекоммуникаций. Все эти документы играют важную роль в обеспечении качества, безопасности и законности продукции, обращающейся на рынке. протокол испытания

Greetings! Very helpful advice within this post!

It’s the little changes which will make the most

important changes. Thanks for sharing!

rikvip là sự lựa chọn hàng đầu cho những ai yêu thích game bài đổi thưởng, với giao diện thân thiện và hàng loạt chương trình ưu đãi giá trị.

https://render.ru/pbooks/2024-04-10?id=11178

Hi would you mind letting me know which hosting company

you’re utilizing? I’ve loaded your blog in 3 different

web browsers and I must say this blog loads a lot faster then most.

Can you suggest a good hosting provider at a fair price?

Thanks a lot, I appreciate it!

nha cai uy tin đảm bảo giao dịch nạp – rút tiền nhanh chóng, minh bạch, giúp người chơi tham gia cá cược một cách dễ dàng và tiện lợi.

Hi! I know this is kinda off topic but I’d figured I’d ask.

Would you be interested in trading links or maybe guest writing a blog

article or vice-versa? My website goes over a lot of the same topics

as yours and I feel we could greatly benefit from each other.

If you happen to be interested feel free to send me an e-mail.

I look forward to hearing from you! Great blog by the way!

nha cai uy tin sở hữu kho trò chơi đa dạng, từ cá cược thể thao, casino trực tuyến đến game bài đổi thưởng, mang đến trải nghiệm giải trí đỉnh cao.

It’s awesome to pay a visit this site and reading the views of all colleagues regarding this post, while I am also zealous

of getting knowledge.

iwin thu hút đông đảo người chơi nhờ vào hệ thống đổi thưởng nhanh chóng, tỷ lệ thắng cao và dịch vụ chăm sóc khách hàng tận tâm.

Right here is the right blog for everyone who would

like to find out about this topic. You understand a whole lot its almost hard to argue with

you (not that I actually will need to…HaHa).

You certainly put a new spin on a subject that has been written about for ages.

Wonderful stuff, just excellent!

iwin là điểm đến lý tưởng cho những ai đam mê game bài đổi thưởng, với giao diện đẹp mắt, dễ sử dụng và nhiều phần thưởng hấp dẫn.

keo nha cai là công cụ không thể thiếu cho những ai đam mê cá cược bóng đá, giúp phân tích và đánh giá kèo cược một cách chính xác.

iwin là lựa chọn hàng đầu cho những ai muốn trải nghiệm game bài đổi thưởng đẳng cấp, với cơ hội nhận thưởng lớn mỗi ngày.

Have you ever considered publishing an e-book or guest authoring on other sites?

I have a blog based upon on the same subjects you discuss and would love to have you

share some stories/information. I know my visitors would enjoy your work.

If you are even remotely interested, feel free to send me

an e-mail.

Atlas123 Slot Gacor Mudah Menang Modal Receh

https://sayanogorsk.info/details/entry/6025-virtualnyj-mobilnyj-nomer-kak-trend-svyazi/

аренда автомобиля адлер прокат авто сочи аэропорт

keo nha cai hỗ trợ người chơi nắm bắt xu hướng cá cược, từ đó đưa ra những quyết định sáng suốt và có cơ hội nhận thưởng cao hơn.

iwin là sân chơi cá cược uy tín, đảm bảo mang đến cho người chơi những giây phút giải trí tuyệt vời cùng hàng loạt ưu đãi hấp dẫn.

can you get generic isordil without a prescription

I do not know if it’s just me or if perhaps everybody else

experiencing problems with your blog. It appears as if some of the written text in your content are running off

the screen. Can someone else please comment and let me know if this is happening to them too?

This could be a issue with my internet browser because I’ve had this happen before.

Thank you

Эффективное продвижение сайтов, новейшие методы.

Секреты успешного продвижения сайтов, изучайте.

Узнайте, как продвигать сайт, что увеличит.

Инновационные методы продвижения сайтов, которые изменят ваш бизнес.

Понимание основ SEO, недоступные никому.

Актуальные стратегии SEO, которые принесут плоды.

Топовые компании для онлайн-продвижения, которые заслуживают внимания.

14 ошибок при продвижении сайтов, за которыми стоит следить.

Как продвинуть сайт без бюджета, узнайте.

Топовые инструменты для анализа, которые станут вашими помощниками.

Метрики для оценки эффективности, чтобы добиться результата.

Роль контента в SEO, о чем многие забывают.

Локальное продвижение сайтов, методы для вашего региона.

Как понять свою аудиторию, которые помогут улучшить результаты.

Важность мобильной версии, это важно.

SEO против контекстной рекламы, по результатам выберите.

Значение ссылочного продвижения, учтите это в стратегии.

Изменения в мире продвижения, изучите подробнее.

Как продвигать сайт в социальных сетях, создавайте интересный контент.

Как правильно оптимизировать, необходимые для успеха.

seo оптимизация seo оптимизация .

We stumbled over here by a different website and thought I may as well

check things out. I like what I see so now i am following you.

Look forward to finding out about your web page repeatedly.

iwin là cổng game đổi thưởng hàng đầu, mang đến trải nghiệm giải trí đỉnh cao với hệ thống game bài, slot và casino đa dạng, phù hợp với mọi người chơi.

娛樂城是什麼

娛樂城是一個線上賭博平台,提供各式各樣的娛樂遊戲,讓玩家能在網路上參與賭博娛樂。玩家可以透過電腦或手機,隨時隨地進行遊戲,並體驗到類似實體賭場的刺激感。娛樂城的遊戲種類多樣,主要包括賭場遊戲、體育博彩、電子遊戲等。在賭場遊戲方面,玩家常見的選擇有百家樂、輪盤、撲克、二十一點等經典賭博項目。這些遊戲通常需要玩家依賴一定的技巧或運氣,來獲得獎金。電子遊戲則包括各種風格的老虎機遊戲,這些遊戲畫面華麗且玩法簡單,非常吸引玩家的注意。而體育博彩則讓玩家根據各類體育比賽的結果進行下注,體驗不同於傳統賭博的樂趣。娛樂城通常還會提供即時直播遊戲,讓玩家可以與真人荷官互動,提升遊戲的真實感。此外,娛樂城平台經常提供優惠活動、註冊獎金等,吸引玩家註冊並增加活躍度。總的來說,娛樂城是集各種線上賭博遊戲於一身的娛樂平台,玩家可以在這裡享受刺激的遊戲體驗。然而,應該注意理性投注,避免過度沉迷。

iwin cam kết mang đến môi trường cá cược công bằng, bảo mật cao, giúp người chơi yên tâm trải nghiệm các trò chơi đổi thưởng đẳng cấp.

keo nha cai cung cấp thông tin kèo cược chi tiết, giúp người chơi đưa ra quyết định sáng suốt và tối ưu hóa lợi nhuận khi tham gia cá độ bóng đá.

Follow UFC fights with http://t.me/s/ufc_ar full tournament schedule, fight results, fighter ratings and analytics. Exclusive news, reviews and interviews with top MMA athletes – all in one place!

You have observed very interesting details! ps decent internet site.

Рейтинг казино проверенных Лучшие 5 казино

http://www.smartphone.ua/news/virtual_numbers_for_voice_sms_registration_76967.html

Can I simply just say what a comfort to uncover somebody who actually understands what they are talking about online. You certainly understand how to bring an issue to light and make it important. A lot more people really need to check this out and understand this side of the story. I was surprised that you’re not more popular given that you definitely possess the gift.

iwin giúp người chơi tận hưởng không gian giải trí hấp dẫn, với nhiều thể loại game bài, slot đổi thưởng và các trò chơi cá cược trực tuyến thú vị.

Excellent way of explaining, and fastidious paragraph to get information regarding my presentation topic, which i am going to convey in college.

iwin là cổng game đổi thưởng chuyên nghiệp, đáp ứng mọi nhu cầu giải trí với hệ thống trò chơi đa dạng và cơ chế đổi thưởng minh bạch.

If you would like to take a great deal from this piece of writing then you have to apply such strategies to your won website.

Хотите испытать волнующее игровое приключение?

Добро пожаловать в Irwin Casino!

Вы найдете разнообразные игры, прибыльные предложения и надежные финансовые операции!

Irwin casino вход.

Почему игроки выбирают Irwin Casino?

Лучшие слоты с высоким RTP.

Разнообразные акции с фриспинами и

кэшбэком.

Быстрые транзакции без скрытых

комиссий.

Интуитивный интерфейс без лишних сложностей.

Дружелюбный саппорт отвечает мгновенно.

Присоединяйтесь к Irwin Casino и получайте максимум удовольствия с максимальными шансами на победу! https://irwin-chucklesphere.site/

iwin là sự lựa chọn hàng đầu dành cho những ai đam mê cá cược trực tuyến, với kho game đổi thưởng đa dạng và giao diện thân thiện.

Hi! I’ve been following your site for a while now and finally got the bravery to go ahead and give you a shout

out from Dallas Texas! Just wanted to mention keep up the great job!

Ahaa, its nice conversation concerning this post at this place at this web site,

I have read all that, so at this time me also commenting here.

keo nha cai mang đến những dự đoán kèo chuẩn xác, giúp người chơi tối ưu hóa lựa chọn cá cược và nâng cao cơ hội chiến thắng.

advair diskus

iwin là cổng game bài đổi thưởng uy tín, mang đến trải nghiệm giải trí đỉnh cao với hệ thống trò chơi đa dạng và tỷ lệ thắng hấp dẫn.

get topamax without insurance

You really make it seem so easy with your presentation but I find this topic to be really

something that I think I would never understand. It

seems too complex and extremely broad for me.

I’m looking forward for your next post, I’ll try to get the hang of it!

Peculiar article, exactly what I needed.

https://gus-info.ru/digest/digest_1751.html

Hey There. I found your blog using msn. This is a really well written article.

I will be sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll certainly comeback.

keo nha cai giúp người chơi phân tích sâu về các trận đấu, từ đó đặt cược hợp lý và gia tăng cơ hội chiến thắng trong cá cược thể thao.

Hey there are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started and create my own. Do you need

any coding expertise to make your own blog? Any help would be really appreciated!

Hi there! Do you know if they make any plugins

to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked

hard on. Any tips?

iwin mang đến những chương trình khuyến mãi hấp dẫn, hỗ trợ người chơi tăng cơ hội trúng thưởng với nhiều ưu đãi đặc biệt.

keo nha cai giúp người chơi tiếp cận với các trận đấu lớn trên thế giới, cung cấp tỷ lệ kèo chính xác để đặt cược hiệu quả.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up!

I’ll go ahead and bookmark your site to come back

in the future. Cheers

Good day! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hello I am so delighted I found your blog, I really found you by mistake,

while I was searching on Askjeeve for something else, Anyways I am here now and would just like to say thanks

a lot for a marvelous post and a all round exciting

blog (I also love the theme/design), I don’t have time to browse it all at the moment but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to

read a great deal more, Please do keep up the superb work.

iwin mang đến không gian giải trí chuyên nghiệp, giúp người chơi tận hưởng những giây phút thư giãn với nhiều tựa game hấp dẫn.

Pretty! This was a really wonderful post. Many thanks for supplying these

details.

keo nha cai là nguồn thông tin đáng tin cậy về tỷ lệ cá cược, giúp người chơi có cái nhìn tổng quan về các kèo đấu trước khi đặt cược.

Heya! I’m at work surfing around your blog from my new iphone

3gs! Just wanted to say I love reading your blog

and look forward to all your posts! Carry on the fantastic work!

Hi there just wanted to give you a quick heads up. The text in your post seem to be running off

the screen in Internet explorer. I’m not sure if this is a format issue or something to do with browser compatibility but I

figured I’d post to let you know. The design look

great though! Hope you get the problem resolved soon. Cheers

keo nha cai giúp người chơi theo dõi và cập nhật tỷ lệ cược mới nhất, từ đó đưa ra quyết định đúng đắn khi tham gia cá cược.

lexapro

iwin mang đến giao diện mượt mà, thao tác dễ dàng trên mọi thiết bị, giúp người chơi có thể tham gia bất cứ lúc nào, bất cứ nơi đâu.

First off I want to say excellent blog! I had a quick

question that I’d like to ask if you do not mind.

I was curious to know how you center yourself and clear your

head prior to writing. I have had difficulty clearing my thoughts in getting my thoughts out there.

I do enjoy writing however it just seems like the first 10 to 15 minutes tend to be lost just trying to figure out how to begin. Any ideas or hints?

Kudos!

https://anti-shpion.ru/ppreimuschestva-virtualnyh-nomerov-udobstvo-i-bezopasnost-dlya-biznesa/

can you buy cheap sustiva no prescription

iwin là sân chơi lý tưởng cho những ai yêu thích thử vận may, với nhiều thể loại game đổi thưởng hấp dẫn và tỷ lệ chiến thắng cao.

This is my first time visit at here and i am genuinely

happy to read all at single place.

Wow that was unusual. I just wrote an very long comment but after I clicked submit my comment

didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say superb blog!

It’s remarkable for me to have a website, which is helpful designed for my know-how.

thanks admin

Играть в казино

Сегодня на рынке представлено множество азартных клубов, но не все они заслуживают доверия https://trademarketclassifieds.com/user/profile/3090601. При выборе надежной платформы важно учитывать такие факторы, как репутация, количество игровых автоматов, быстрый вывод средств, а также щедрая программа лояльности. Например, такие бренды, как 1Win, R7 казино и Гамма казино, зарекомендовали себя как надежные партнеры для игроков.

Рейтинг самых популярных платформ

Если вы ищете надежные клубы, обратите внимание на следующий список:

1Win – клуб с быстрыми выплатами.

R7 казино – платформа с удобным интерфейсом.

Гамма казино – платформа с высоким уровнем безопасности.

Rox casino – казино с уникальными турнирами.

Sol Casino – платформа с разнообразными бонусами.

Jet Casino – казино с высоким рейтингом.

Strada казино – игровой портал с уникальными слотами.

Booi казино – платформа с надежной репутацией.

Казино Monro – игровой портал с уникальными акциями.

Казино Vavada – игровой портал с щедрыми бонусами.

Слоты на деньги с быстрым выводом

Играть в игровые автоматы на реальные деньги – это не только увлекательно, но и выгодно. Современные платформы, такие как Казино Вулкан Играть Онлайн – качество, проверенное временем, предлагают разнообразные азартные игры. Среди популярных игр можно выделить игры с прогрессивными джекпотами. Например, в R7 казино представлены игры с высоким RTP.

Секреты успешной игры

Чтобы играть и выигрывать, важно следовать нескольким правилам:

Выбирайте проверенные казино.

Анализируйте стратегии.

Участвуйте в акциях.

Не рискуйте большими суммами.

Чем привлекают азартные игры

Онлайн казино, такие как 1Win, R7 казино и Гамма казино, предлагают множество преимуществ:

Доступ к играм с любого устройства.

Широкий выбор игр.

Гарантия получения выигрышей.

Щедрые бонусы.

Опыт других игроков

Многие игроки делятся своими опытом игры. Например, пользователи Rox casino отмечают щедрые бонусы. В Jet Casino игроки ценят честные игры.

Итоги

Выбирая надежный клуб, важно учитывать репутацию и условия игры. Платформы, такие как Казино Вулкан Играть Онлайн – качество, проверенное временем, 1Win, R7 казино и другие, предлагают гарантию честной игры. Играйте ответственно и получайте удовольствие от азартных развлечений!

Generally I don’t read post on blogs, however I would like to say that this write-up very

pressured me to try and do it! Your writing taste has been amazed me.

Thank you, very great post.

I am curious to find out what blog platform you have been using?

I’m experiencing some small security problems with my latest website and I would like to find something more risk-free.

Do you have any recommendations?

Hello, after reading this remarkable paragraph i am as

well cheerful to share my experience here with friends.

Играть в казино

Если вы ищете топовые площадки с выводом средств, то наш обзор от Топ онлайн казино на реальные деньги от PlayBestCasino.ru поможет вам сделать правильный выбор https://yogaasanas.science/wiki/User:BarbGlyde013119. Мы проанализировали такие популярные бренды, как 1Win, R7 казино, Гамма казино, Rox casino, Sol Casino, Jet Casino, Strada казино, Booi казино, казино Monro и казино Vavada, чтобы предоставить вам актуальную информацию.

На что обратить внимание при выборе платформы

При выборе онлайн казино с выводом средств важно учитывать несколько ключевых факторов. Среди них: репутация платформы. Например, R7 казино славится своими быстрыми выплатами, а Jet Casino предлагает уникальные бонусы для новых игроков.

Самые популярные казино 2023 года

1Win – высокие коэффициенты.

Rox casino – надежная поддержка.

Sol Casino – уникальные бонусы.

Booi казино – интуитивный дизайн.

Vavada – удобный вывод средств.

Почему стоит выбрать топовые казино

Игра в топ онлайн казино имеет множество преимуществ. Среди них: высокие шансы на выигрыш. Например, Strada казино предлагает уникальные слоты, которые вы не найдете на других платформах.

С чего начать новичку

Если вы новичок и хотите играть в казино на реальные деньги, начните с регистрации на одной из проверенных платформ, таких как Гамма казино или казино Monro. После этого вы сможете воспользоваться приветственным бонусом и начать играть.

Рекомендации от экспертов

Чтобы увеличить свои шансы на успех, следуйте простым советам: выбирайте игры с высоким RTP. Например, в R7 казино регулярно проводятся акции, которые помогут вам увеличить свой депозит.

Игровые автоматы с выводом средств

Если вы ищете слоты с быстрым выводом, обратите внимание на такие платформы, как Rox casino и Sol Casino. Они предлагают широкий выбор игр от ведущих провайдеров, таких как NetEnt, Microgaming и Play’n GO.

Советы по выбору аппаратов

При выборе игровых автоматов с выводом важно учитывать такие параметры, как процент возврата (RTP). Например, в Jet Casino вы найдете слоты с RTP выше 97%.

Топ-3 игровых автомата 2023 года

Book of Ra – классический слот с высоким RTP.

Starburst – яркий дизайн.

Gonzo’s Quest – высокий потенциал выигрыша.

Почему стоит выбрать топовые казино

Выбор лучшего казино для игры на деньги – это важный шаг, который требует внимательного подхода. Наш рейтинг от Топ онлайн казино на реальные деньги от PlayBestCasino.ru поможет вам найти надежную площадку, такую как 1Win, R7 казино или Vavada, и наслаждаться азартными играми с максимальным комфортом.

Luxury1288

Quality articles is the key to invite the visitors to pay a visit the site, that’s what this web page

is providing.

Wow quite a lot of superb info!

astelin

can you buy cheap secnidazole online

Играйте в Mostbet Casino https://mostbet.spas-extreme.ru лицензированное онлайн-казино с огромным выбором игр! Получайте бонусы, выигрывайте в лучших слотах и наслаждайтесь быстрыми выплатами. Удобные способы пополнения счета!

Every weekend i used to pay a visit this web page, for the reason that i wish for enjoyment, as this this site

conations really good funny information too.

نحوه درس خواندن در ماه رمضان، ماه رمضان برای دانشآموزان و دانشجویان، حفظ تعادل بین عبادت و مطالعه در این ماه از اهمیت ویژهای برخوردار است.

Hello! I just want to offer you a big thumbs up for the excellent info you have got right here on this post. I’ll be returning to your website for more soon.

Hi there, its pleasant post about media print, we all know media is a great source of facts.

Pretty! This has been an extremely wonderful post.

Many thanks for supplying this information.

Muito bom! Estou muito satisfeito.

I love what you guys tend to be up too. This kind of clever work and reporting!

Keep up the superb works guys I’ve added you guys to blogroll.

کندو مای مدیو، سایت کندو به آدرس kandoo.medu.ir توسط مرکز توسعه ی آموزش مجازی، فناوری و امنیت اطلاعات وزارت آموزش و پرورش در جهت ارائه بستر آموزش مناسب در مقطع های مختلف تحصیلی راه اندازی شده است.

whoah this weblog is excellent i love studying your posts.

Keep up the good work! You know, a lot of persons are

looking around for this info, you could aid them greatly.

My relatives all the time say that I am killing my time here at

net, however I know I am getting know-how every day by reading such

pleasant articles.

I know this if off topic but I’m looking into starting my own weblog and was curious what all is required

to get set up? I’m assuming having a blog like yours would

cost a pretty penny? I’m not very web savvy so I’m not 100% certain. Any suggestions or

advice would be greatly appreciated. Kudos

It’s an remarkable article in support of all the online users; they

will obtain benefit from it I am sure.

مای مدیو اشتغال به تحصیل، سامانه مای مدیو توسط آموزش و پرورش برای ارائه خدمات الکترونیکی به دانش آموزان و فرهنگیان راه اندازی شده است.

I agree with you. I wish I had your blogging style.

imitrex

Excellent towing service! They arrived quickly and handled my car with great care. Highly recommended!

order cheap prothiaden no prescription

Игровые автоматы с бездепозитным бонусом за регистрацию с выводом Бесплатные спины за регистрацию без депозита с выводом

Undeniably consider that which you said. Your favorite justification appeared to

be at the web the easiest thing to understand of.

I say to you, I certainly get annoyed while other folks consider worries that they just

don’t recognize about. You managed to hit the nail upon the highest as smartly as outlined out the entire thing without

having side effect , other people can take a signal. Will likely be again to get more.

Thanks

Viagra * Cialis * Levitra

All the products you are looking an eye to are currently available in support of 1+1.

4 more tablets of an individual of the following services: Viagra * Cialis * Levitra

https://pxman.net

Автополив участка — это идеальное решение для вашего сада и дачи. Установка автоматической системы орошения обеспечит эффективный полив с минимальными усилиями. Мы предлагаем комплексные услуги по проектированию, монтажу и пусконаладке оборудования. Наша ландшафтная студия создаст оптимальную планировку, а обслуживание системы избавит вас от лишних забот. Насосы и поливочные установки гарантируют здоровье вашего газона и растений. Доверьтесь профессионалам — укладка и настройка оборудования пройдет быстро и надежно https://1landshaftniy-dizayn.ru/

https://frumzi.gr.com/

Hi! I know this is somewhat off topic but I was wondering

if you knew where I could locate a captcha plugin for my

comment form? I’m using the same blog platform as yours and I’m having difficulty finding

one? Thanks a lot!

Aw, this was an extremely good post. Spending some time and actual effort to make a good article… but what

can I say… I hesitate a whole lot and never seem to get anything done.

What’s Taking place i’m new to this, I stumbled upon this I have found

It absolutely helpful and it has helped me out loads.

I am hoping to contribute & assist different

users like its helped me. Good job.

Quality content is the secret to interest the viewers to visit the web site, that’s what this web

site is providing.

“`spintax

I’ll right away clutch your rss feed as I can not find your e-mail subscription hyperlink or e-newsletter service.

Do you’ve any? Kindly allow me recognise so that I may subscribe.

Thanks.

myambutol

Everything is very open with a clear clarification of the issues.

It was definitely informative. Your website is extremely helpful.

Thanks for sharing!

Highly energetic article, I liked that a lot.

Will there be a part 2?

how to buy generic primaquine for sale

Fast and reliable roadside assistance! The team was professional and friendly. Will definitely call them again if needed.

Hmm is anyone else having problems with the images on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any feedback would be greatly appreciated.

Wow, wonderful blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your web site is

excellent, as well as the content!

امریه دانشگاه پیام نور، فرصتی است برای فارغالتحصیلان دانشگاهی که میخواهند دوره خدمت سربازی خود را در محیط علمی و مرتبط با رشته تحصیلیشان سپری کنند.

Great article.

Hello to all, how is the whole thing, I think every one is getting more from this website, and your views are pleasant in support of new

people.

Hi! This is my first comment here so I just wanted

to give a quick shout out and tell you I really enjoy reading your articles.

Can you recommend any other blogs/websites/forums that cover the same subjects?

Thanks for your time!

Howdy are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and create my own. Do you

need any coding knowledge to make your own blog? Any help would

be really appreciated!

These are in fact impressive ideas in concerning blogging.

You have touched some pleasant factors here. Any way keep

up wrinting.

I’m gone to inform my little brother, that he should also pay a quick visit

this website on regular basis to take updated from newest information.

Genuinely when someone doesn’t understand then its up to other

people that they will assist, so here it takes place.

cytotec

I don’t even know how I ended up here, but I thought this

post was great. I don’t know who you are but certainly you are going to a famous blogger if you aren’t already

😉 Cheers!

can you get persantine price

Its such as you read my thoughts! You appear to know a

lot about this, such as you wrote the guide in it or something.

I think that you simply can do with a few %

to pressure the message house a little bit, but instead of that, that is excellent blog.

An excellent read. I will certainly be back.

Hi there! I just want to offer you a huge thumbs up for your excellent information you have got right here on this post.

I will be coming back to your blog for more soon.

Oh my goodness! Impressive article dude! Thanks, However I am going through troubles with your RSS.

I don’t understand why I cannot subscribe to it. Is there anybody

else getting identical RSS issues? Anyone who knows the answer will you kindly respond?

Thanx!!

Quality articles or reviews is the secret to interest the

visitors to visit the web page, that’s what this web page

is providing.

iwin là cổng game bài đổi thưởng uy tín, mang đến hệ thống trò chơi đa dạng, giao diện đẹp mắt và tỷ lệ thắng hấp dẫn.

iwin là điểm đến lý tưởng cho những ai yêu thích cá cược trực tuyến, với nhiều chương trình khuyến mãi hấp dẫn và tỷ lệ đổi thưởng cao.

Откройте для себя невероятные эмоции с Slotozal Casino, где времяпрепровождение превращается в незабываемое приключение. В нашем казино доступен бесконечное разнообразие слотов, классических игр, таких как покер, блэкджек, рулетка.

Почему выбирают Slotozal Casino? Мы стремимся предложить лучшее обслуживание, чтобы каждая игра была запоминающейся. Готовы попробовать свои силы в турнире? У нас постоянно идут захватывающие турниры, которые предлагают шанс на внушительные выигрыши. Вступайте в игру и убедитесь в этом лично – https://slotozal-funorbit.space/.

Slotozal Casino – это выбор тех, кто ценит время и качество. Перед началом ознакомьтесь с нашими правилами, чтобы ваши ставки были комфортными:

Начать с демо-режима – отличный способ освоиться и почувствовать себя уверенно.

Если вы опытный игрок, воспользуйтесь нашими привилегиями и бонусами для VIP-пользователей.

Для тех, кто не играл некоторое время, демо-игры – отличный способ вспомнить правила и вернуться к игре.

Выбирайте Slotozal Casino – и каждый ваш день станет наполнен азартом и удачей!

iwin cung cấp hệ thống nạp – rút tiền nhanh chóng, minh bạch, giúp người chơi dễ dàng quản lý tài khoản cá cược.

bonus casino Бездепозитные фриспины

tricor

Dreaming of big wins? Then Starda Casino is your best option!! Here you’ll find top gambling entertainment with advanced bonuses. https://starda-strike.top to test your luck in top slots!

Why do thousands of players choose us?

Over 2,000 games featuring progressive jackpots.

Generous bonuses and promotions on the first deposit.

Fast payouts processed in record time.

Modern platform without lags or crashes.

Technical support around the clock providing instant responses.

Become part of the gambling world to enjoy the ultimate gaming experience!

That is a really good tip particularly to those fresh to the

blogosphere. Brief but very accurate info… Many thanks for

sharing this one. A must read post!

Useful info. Fortunate me I discovered your web site unintentionally, and I

am surprised why this coincidence did not came about earlier!

I bookmarked it.

Ascending pyramids are appropriate for all bodybuilding lifters, but descening pyramids is a extra advanced training technique. Newbies and intermediate bodybuilders do not want to train to failure. If you do it, make positive you don’t overdo it and compromise your recovery. A bodybuilder primarily excited about muscle progress has more freedom. Current analysis shows that utilizing heavy weights and low reps is superior for strength growth, and lightweight weights and a lot of reps are finest for muscle endurance.

This will help you break up your workout and will enable alternating muscle teams extra relaxation. Sometimes what’s recommended is a calorie surplus, where you’re gaining weight and consuming extra energy than your physique needs everyday. Perform about 50% of these sets with both lengthened partials as an alternative of full range of motion reps, or with lengthened partials accomplished after your regular set. If you attempt to do full physique 5x per week training all to failure, all with 20 plus units per week, with out deloading, you understand that one thing has to offer. Some folks imagine you must take your sets to all-out failure, the purpose the place your muscular tissues can not carry the load. So, we ran a study to try to see whether rising reps or rising in load was higher for muscle growth.

Additionally, just keep in mind to alternating between the workout routines which are already in this system. Beginner lifters generally experience something called “newbie gains”. Normally, we recommend doing a couple of good exercises per muscle group. But in the case of the shoulder muscles, we’re essentially looking at three completely different muscle tissue in a single. Shifting back to a compound exercise, the behind-the-neck press is a variation of the standard overhead press. If you already do lots of urgent workouts, you might already work your entrance delts sufficiently, in which case you can save your isolation work for the following train. The front increase is an anterior deltoid isolation train, and you may carry out it with a barbell, dumbbells, and even only a weight plate.

As you will be working only one muscle whole here, this means much less weight lifted. These are excellent then for inducing sarcoplasmic hypertrophy. Given all of this info, we are in a position to now use it to help develop a correct pure bodybuilding program. Discover how we can help you turn out to be one of the best version of your self by reserving a free session right now at our Richmond private training studio.

By stripping the load back to 60 pounds, you’ll find a way to use strict form, the place the one movement is thru the elbow joint. Use a heavy weight and give consideration to the eccentric with a three second decrease of the rep. Focus on totally stretching and elongating the lats throughout this unfavorable portion of the rep. You must also avoid utilizing momentum to deliver the load up. That applies to all exercises but is a key cause that most individuals fail to get any profit from this explicit motion. That’s what happens when you relaxation greater than two minutes between sets. Arnold Schwarzenegger, also known as the Austrian Oak, is a world-renowned actor, politician, and professional bodybuilder.

Nonetheless, Josh cautioned that though coaching to failure could lead to extra development if you look at just 1 set in isolation, it also creates more fatigue. Brad then explained how folks excited about learning the method to construct muscle in stubborn groups may strategically use larger volumes to drive development. The next piece of the tips on how to build muscle puzzle is volume and frequency.

Going on a diet to lose fat before taking on energy training is a giant mistake and never an uncommon one. You need to combine a weight-loss food regimen with bodybuilding coaching. That approach permits you to keep or acquire muscle whereas leaning out. You train your pushing muscular tissues (chest, shoulders, and triceps) on day one, your pulling muscular tissues (back and biceps) on day two, and finish off with legs (and maybe calves) on day three.

Nevertheless, the days of the week that you just practice aren’t set in stone. If you can’t make it to the fitness center on Monday, Wednesday and Friday, you would always prepare on Tuesday, Thursday and Saturday. You’ll discover a hyperlink to the 3 day full body exercise PDF at the backside of this page.

A newbie doesn’t want a large number of sets to stimulate muscle growth. Full-body coaching offers a quantity of advantages for the newbie. Instead of completely destroying a muscle group with a dozen or more units, which may require many days to recover from, you practice every muscle a little each exercise, however you do it extra often.

However if you’re in a position to do this transfer, it’s nice for adding dimension to the delts. That said, we advise you switch the order of squats each week—in week 2, for example, do common squats first, and in week 3, start off with Smith machine squats. This will ensure a well-balanced leg protocol via the course of four weeks. At a glance this may appear counterproductive for constructing muscle.

Too typically, trainees attempt to go to the fitness center and kill it each exercise. Using a full body exercise is a extremely efficient approach to prepare, but that’s not its solely benefit. Here are the top benefits of utilizing a full body workout coaching program. When getting started with this program, find a weight that is difficult but doable. For instance, if you take a look at the rep schemes, you’ll observe a 5×5 for the squat.

Somewhat, I’m going to provide you 5 bodybuilding coaching splits. And on the end of this submit, I’ll show you the way you to alternate all of these training splits to change up your routine. Use a coaching log to track weights, units, and reps. Regulate primarily based on performance. Even although you do not improve the burden on every set, the cumulative effect of your reps will make every set progressively more durable. Nevertheless, it is vital that you are strict on both your relaxation time and your exercise kind for every single a type of 36 reps. On your first three units, you do 8-10 reps, going as heavy as you presumably can with correct type.

As A Outcome Of you’re practically resting one leg half the time, you can hold the rest interval between your sets to 90 seconds to 2 minutes. After a couple of warm-up units, perform 4 units of eight reps. Keep your relaxation periods to around two minutes, and focus on correct type going from a full stretch to a maximal contraction. A latest examine discovered that seated leg curls lead to greater muscle development in comparison with leg curls.2 Nonetheless, the sartorius muscle grew better from lying leg curls. The two leg curls variants connect your hamstrings barely in a unique way, so it might be finest to incorporate them both for optimum hamstring development. These are the supplements I believe can benefit you the most. Some, like caffeine, are supported by scientific proof and assist your efficiency in the gym a bit.

Make positive you’ve at least 6 months value of stable coaching experience earlier than you attempt a excessive frequency break up like this. It’s all about thick, vascular muscle mass and bar-bending, brute-force strength. This kind of workout will permit your physique to recuperate and you may discover that you’re stronger once you begin back on your regular routine.

They present too little of a number of amino acids to stimulate muscle protein synthesis effectively. For example, in a bicep curl, partial reps may contain solely lifting the load halfway up and decreasing it again down rather than curling all of it the method in which up. Failure is the point at which you’ll have the ability to no longer complete another repetition of a particular set with proper type and technique. Attempt doing a set of barbell curls with a weight which you estimate you are capable of do 30 reps. Now curl that bar to failure. Even if you’re highly motivated and love being within the fitness center, coaching every day can lead to burnout and grind your progress to a halt. The downside of coaching a muscle group only once weekly is that your coaching quality might suffer in the course of the end of the exercise. Training every muscle group frequently is usually thought of the greatest way to keep MPS elevated and stimulate muscle progress.

Discover the cheat that athletes use to cut fat shortly and get defined muscular tissues. How I suggest doing this is to have a heavy again workout adopted by a more concentrated again exercise 3-4 days later. One of the ways to verify you’re rising this muscle is to hit it twice per week. The program incorporates components of practical hypertrophy with controlled eccentrics, various gear, and a stability of volume and depth.

However with so many shoulder workouts out there, it can be overwhelming to know which ones to prioritize. This article is especially meant for these over the age of 50 who are new to the lifting game. Which ones are value your cash, and which are questionable or useless? Check our StrengthLog’s Supplement Guide, our free information where I evaluate 26 of the preferred supplements. Omega-3s are important fatty acids your physique requires for many issues. They maintain your cells healthy and are crucial to maintaining your heart, blood vessels, and immune system in form, amongst other things. Base your carbohydrate consumption on good, healthy selections as an alternative of easy, refined sugars.