Vietnam’s economy recovered well in the first half of 2022, growing by 7.72 percent on the back of strong exports and consumer expenditure.

Here, Vietnam Briefing presents a report on how the International Monetary Fund (IMF) examined specific economic patterns with a bullish assessment of the growth of the nation.

The International Monetary Fund (IMF) claims that Vietnam’s robust economic development is taking a different course from the other nations in Asia, which are seeing a decreasing trend. Additionally, because internal inflation pressures have mostly been contained to fuel prices and directly associated services like transportation, Vietnam’s inflation rate has also stayed under control.

Despite an increase in the first seven months of the year, consumer prices are still below the central bank’s 4% annual objective. This is partially attributable to Vietnam’s tardy recovery in 2021, which has managed to contain inflation while keeping food and energy costs below regional averages.

IMF is upbeat about Vietnam’s development

According to the IMF, the nation’s adaptable adoption of a living-with-COVID policy and widespread immunization coverage are responsible for these results.

Strong manufacturing production, a revival in retail and tourism activity, and support measures including low-interest rates, rapid credit expansion, and the government’s Programme for Socio-economic Recovery and Development have all contributed to these developments.

Due to the nation’s abundant domestic supplies, declining prices for pork, which continues to be the locals’ preferred protein, from last year’s peak, and a preference for rice, which remains more affordable than other grains like wheat, the global surge in food prices has also had a minor impact on domestic consumer prices. Additionally, price increases for services like health and education have been fairly modest.

With such a positive outlook, the IMF recently increased its prediction for Vietnam’s growth rate to 7% this year from 6% three months earlier. Notably, among the other major Asian nations, this is the IMF’s sole big upward revision.

Vietnam’s projected growth rate for 2023 has been cut by the organization by 0.5 percentage points to 6.7%, but even so, this is still a positive prognosis compared to the generally gloomier forecast elsewhere, and it would be the quickest rate among Asia’s major economies.

In the most recent World Economic Outlook Update, the IMF revised its growth projections for Asia as a whole downward, to 4.2 percent and 4.6 percent for this year and next, respectively.

Key challenges

Despite Vietnam’s very low inflation rate, it may rise when more economic activity in the nation recovers. According to the IMF, rising costs for transportation and supplies like fertilizer and animal feed may also result in higher prices for domestic products and services, which would increase inflationary pressure on the economy.

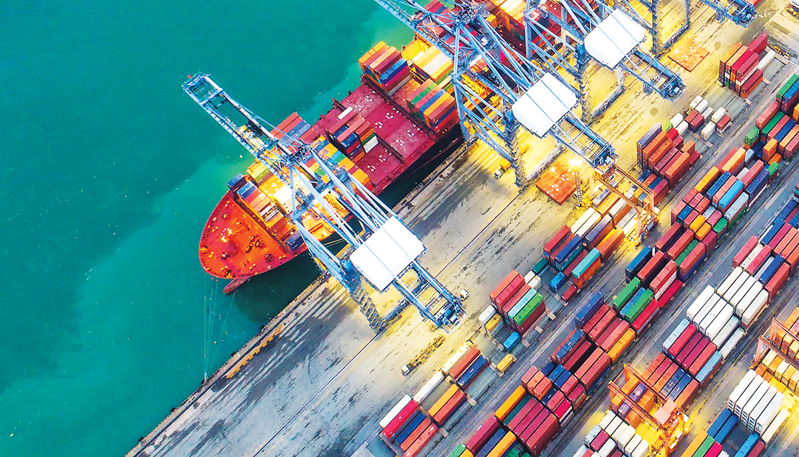

Another obstacle to Vietnam’s recovery may be the global economic slowdown, which includes China, the largest industrial economy in the world, and other significant advanced economies. In particular, the consequences of the Russia-Ukraine situation were taken into account when the IMF’s World Economic Outlook revised its projections downward to 3.2 percent this year and 2.9 percent next year. Lower demand for Vietnam’s exports, particularly from key trading partners like the US, China, and Europe, results from this recession.

In addition, when financial conditions tighten as the US and other developed countries boost interest rates to combat inflation, Vietnam may also experience the consequences of rising borrowing costs and more capital outflows.

Last but not least, challenges such as a lack of raw materials, access restrictions to essential intermediate products, and more supply-chain disruptions may result in increased uncertainty over international commerce and financial markets.

The IMF study as a whole suggests numerous crucial steps that the economy should take to deal with these challenges, including:

- With prompt and adaptable reforms, fiscal policy should take the lead in the nation’s economic recovery;

- Rising inflationary threats should receive significant attention from the central bank;

- It’s important to regularly monitor both possible threats in the real estate markets and bad loans in the banking sector;

- To fully realize Vietnam’s enormous development potential, the government should push ahead with more economic changes in areas such as institutions, rules, digital connection, labor, social safety net coverage, and the nation’s environmental agenda.